Royal Bank of Scotland Spread betting example

After the recent news we have had in the banking sector, here is an example of spread betting RBS (Royal Bank of Scotland).

Three days ago the news came out JPMorgan Chase acknowledges $ 2 billion trading loss. You strongly feel that this is a big story that will affect the banks, as JPMorgan Chase is the largest bank in the United States, and this would be a big loss of its own money. The news came out on the 10th May after hours, you decide to take a short trade the following Morning.

The Night before RBS was trading at 23.20. You wait for the market to open the next morning. RBS opened at 22.90 and starts moving lower:

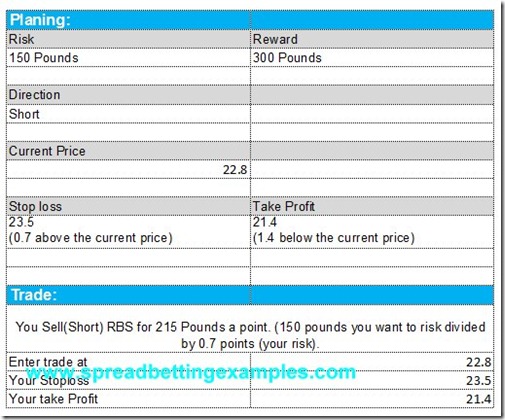

You decide you would like to risk 150 pounds and look to take profit of 300 pounds. You look at the charts and you want to place your stoploss above Thursday’s high of 23.30. And you would like to take 300 Pounds profit. You calculate that the distance from the current price of 22.80 to the stoploss level of 23.50 is 0.7. You divide 150 GBP by 0.7, and you get your stake of 215 Pounds a point. Then you are looking for a ration of 1:2, you would like a limit (Profit) of 300 GBP with a distance of 1.4 points. You place your limit at 21.40.

As you can see from the Spread betting examples of Royal Bank of Scotland the trade went in your favour, You took a profit of 300 Pounds. If Instead it had gone against you, you would had lost 300 GBP

If you want to read a bit more on risk, you can see the section on Money Management

Summary:

Other examples of trading the banking sector: Spread betting example of Barclays shares

Return to the Spread Betting Example section.