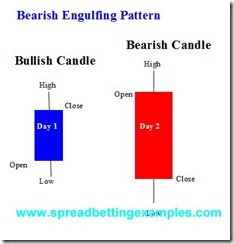

Bearish Engulfing Pattern

The Bearish Engulfing Candlestick Pattern is a bearish reversal pattern, which usually occurs at the top of an up trend and it consists of a a small bullish candlestick with a small tail followed by a reversal candlestick that overshadows or "engulfs" the small bullish one. The opposite of the Bearish Engulfing pattern is the Bullish Engulfing pattern.

Smaller Bullish Candle (Day 1)

Larger Bearish Candle (Day 2)

So how does this pattern form?

Generally, we find ourselves in an uptrend and a bullish candle forming on Day 1. On Day 2 prices gap upwards but opening higher than Day 1 open.

On Day two the market gapped up, but the bulls fail to push prices higher. Normally this occurs when we approach near a resistance level, where there are many bears awaiting. The strength of the bears and weakness of the bulls pushes Day 2 to close lower than Day 1. In this scenario the body of Day 2 has engulfed Day 1, forming the Bearish Engulfing Pattern.

As stated above, this occurs near resistance point or pivot point, or just a strong change in sentiment in the markets. In fact prices go from a bullish gap up at the open, to the big red bearish real body candle that closes lower than the previous day’s close. Bears have successfully overpowered the bulls on the day and the sentiment is likely to continue for the few periods.

A spread betting example of a Bearish Engulfing Pattern and how to apply it in a strategy

Here is a chart below of African Barr Gold, that illustrates a Bearish Engulfing Pattern at the top of an uptrend. The question is when to sell.

1) Sell near the close of Day2. As it comes close to the end of the day, and the prices are closing lower than the previous day’s close. This is a negative sign, the more aggressive traders will sell near the close so they try to anticipate a downward move the following day(3). Ideally this pattern is accompanied by volume confirmation.

2) Sell on the open of Day 3. These are traders that wait for the complete pattern to form. End of day traders. Once they recognize the pattern they sell on the Day 3 open.

3) Wait for further confirmation to sell. Here are the more cautious traders that look for further confirmation. or look for a good entry point to sell, maybe a little bounce back up to a resistance point, then they sell. As it happened in day 3 and day 6.

The Bearish Engulfing Pattern is one of the strongest candlestick reversal patterns. The opposite pattern is the Bullish Engulfing Pattern.

Back To Candlestick Patterns