Hammer

Bullish Reversal Pattern

What is a hammer?

The hammer is a bullish reversal candlestick. Most bullish reversal patterns this pattern will

-occur within a downtrend or at the bottom of a trend

-Often it is followed by a confirmation candle.

Be aware with bullish reversal candlesticks this is a warning sign of a possible change in trend, but it is not a signal. Traders normally look for confirmation of a change of trend on the next candle.

Formation:

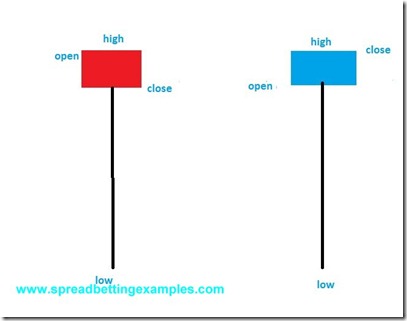

The formation of the hammer , very similar to a hanging man , this is created when the opening, closing and low prices of the candlestick are in the same area. The hammer will have a long downward shadow. Normally the shadow is 2 to 3 times the size of the body. The main difference between the hammer and the hanging man is that the hammer occurs at the bottom of the trend and it is a bullish reversal pattern, instead the hanging man occurs at the top of a trend and it is a bearish reversal pattern.

The hammer as the hanging man is created when we get to an oversold area or support point where the bulls are strong. The bulls will stop the prices from moving any lower and push them back up to the opening price. On the next candle the bulls will push the prices higher. This shows a change in strength and the bulls taking control.

The hammer is a strong reversal pattern.

A hammer is often applied to many price action spread betting strategies. Below is a spread betting example of the hammer.

How to trade the hammer?

Below is a Forex Spread betting example of the EURUSD. As you can see prices started falling until the bears met with the bulls that were strong enough to turn around the prices. In a trading strategy the hammer is your warning signal of a change of trend. The candle stick that follows is a strong bullish candle as it closes near it’s highs. On the close of the confirmation candle will conservative traders enter a new trade.