Shooting Star

Bearish Reversal Pattern

What is a Shooting Star?

The shooting star is a bearish reversal candlestick. Most bearish reversal patterns this pattern will

-occur within an uptrend or at the top of a trend

-Often it is followed by a confirmation candle.

Be aware with bullish reversal candlesticks this is a warning sign of a possible change in trend, but it is not a signal. Traders normally look for confirmation of a change of trend on the next candle.

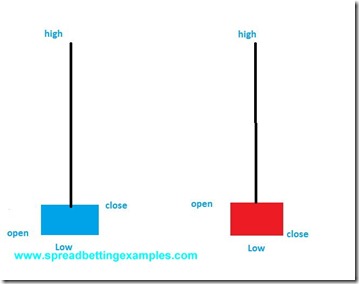

Formation:

A shooting star is created when the opening, closing and low prices on a candlestick are in the same area. The shooting star will have a long upward shadow. Normally the shadow is 2 to 3 times the size of the body. The whole theory behind this is that prices have been moving higher until they reach a high point or a resistance. They try move higher but the sellers come in and push the prices all the way back down to the opening price. This shows the strength in the sellers.

A strong pattern shooting star is formed when the closing price is in line with the opening price or is lower than the opening price.

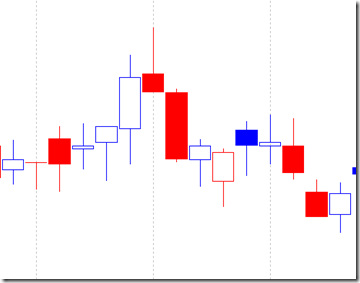

Shooting stars are often applied in many price action spread betting strategies. Below is a spread betting example of the shooting star.

Here is an example of the shooting star applied in a scalping spread betting strategy on the FTSE.

How to trade the shooting star?

Below is a spread betting example of a shooting star in GSK.L

As you can see in this strategy the prices were moving in an uptrend, until prices reached a new high. At this high, a lot of selling pressure comes into the market that pushes the prices way below the opening price of the candle. The next day is dominated by sellers again that the prices close near their lows on a very strong bearish candle. The Bulls try another attempt but are unable to push higher the following day. The shooting star is the first candle that marks a change in trend.