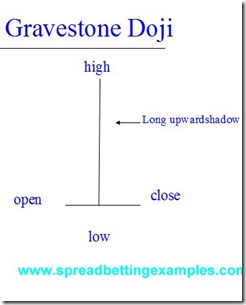

Gravestone Doji

On the other hand we have the Gravestone Doji, which is a strong bearish candlestick pattern that occurs at the top of bull trend, often near the highs.

The Gravestone Doji, as a typical Doji has it’s opening and closing at close to the same price. Rarely these two prices are the same price. However the most important feature of the Gravestone doji is that it has a long upward shadow.

This long shadow implies that the market tries to make new highs but find strong bearish resistance that push it all the way down to where prices started off, or opened. Therefore there is an overpowering of the bears over the bulls.

Below is a spread betting example of the Gravestone Doji in a Forex EURUSD trade.

As you can see prices were heading higher in an uptrend, slowed down, then tried to push higher until the bulls found bears defending the higher prices. These bears pushed the prices back to the candlestick’s opening price (gravestone Doji). The candlestick that followed was a strong bearish candlestick.

The Gravestone Doji is extremely helpful to indicate where there is strong resistance. If this resistance is broken we can find a substantial move higher.

In a spread betting system a trader would wait for the following bearish candlestick after the Gravestone Doji, as confirmation of the trend reversal. It is important to use a confirming candlestick. Some more aggressive traders would enter as the Gravestone Doji is formed; maybe with smaller stakes taking on smaller risks.

Back to Doji candlestick pattern

Back to candlestick patterns