Doji Candlestick

A doji is a very strong candle it show a lot of indecision between the bulls and the bears. Often a Doji is sign of reversal but can also be sign of a continuation. Doji’s are normally found at the bottom of a downtrend. Doji refers to both singular and plural.

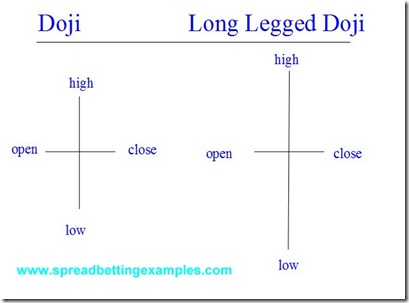

The formation of the Doji is when the opening and closing price are the same. When the shadow of the Doji is extremely long this type of Doji is called a long legged doji. Then we have the “Rickshaw Man” which is also a Doji but the difference is that the Rickshaw Man has the opening and closing in the middle of the candle.

The Doji represents indecision, as the bears push prices higher, but then the bulls come in and fight prices lower to then end up at the starting point or opening price.

Below is a spread betting example of a Doji formed in a down trend. As you can see the prices were heading lower until the bears started running out of steam and the bulls took over at the end of the downtrend but were pushed back closing in line with the opening price. The following candle the bulls give it a second chance to gain ground and start pushing prices higher. When a Doji manifests it’self this is a reversal warning signal that there might be a change in trend. This signals either to start scaling down on your position, closing your position or to monitor and be on the alert of a price trend change.

The Doji, is a strong indecision candle but not necessarily a reversal candle, hence it is more a warning candlestick than an actual reversal signal.

Forex Spreadbetting Doji on AUDUSD

While looking at your spreadbetting charts always keep an eye out for the Doji. You can also implement this in a spread betting strategy, but do keep in mind that it is more a warning sign than an actual reversal pattern. Now that we have seen what is a Doji, let’s look at intra day how it is formed.

This is a spread betting example of the Doji intra day. There are many ways of forming a Doji.

Prices opened the day after the overnight drift, heading higher, but soon the bears came in pushing prices lower continuing with the main trend down. Prices make new lows but these lows are defended buy the bulls that push prices higher to then return to the opening price.

There are other powerful Doji Patterns

- Dragonfly Doji

- Gravestone Doji

Go back to spread betting candlesticks