Hanging Man

Bearish Reversal Pattern

The hanging man is a bearish reversal candlestick. Most bearish reversal patterns this pattern will

-occur within an uptrend or at the top of a trend

-Often it is followed by a confirmation candle.

Remember with bullish reversal candlesticks, these are warning sign of a possible change in trend, but it is not a signal. Traders normally wait for confirmation of a change of trend on the next candle.

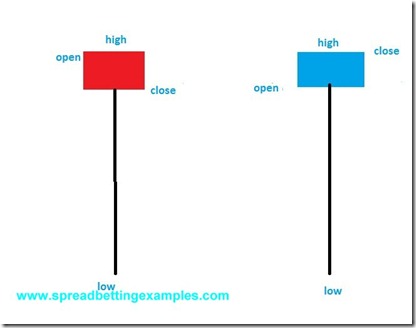

Formation:

The formation of the hanging man , very similar to a hammer, this is created when the opening, closing and low prices on a candlestick are in the same area. The hanging man will have a long downward shadow. Normally the shadow is 2 to 3 times the size of the body. The main difference between the hammer and the hanging man is that the hammer occurs at the bottom of the trend and it is a bullish reversal pattern, instead the hanging man occurs at the top of a trend and it is a bearish reversal pattern.

The hanging man is created because the moment we get to an overbought level or a resistance point where the bears are strong, they stop the prices from moving any higher. On the next candle the bears actually push the prices lower. This shows a change in strength and the bears pushing prices back down.

The hanging man is not as strong reversal pattern as the shooting star.

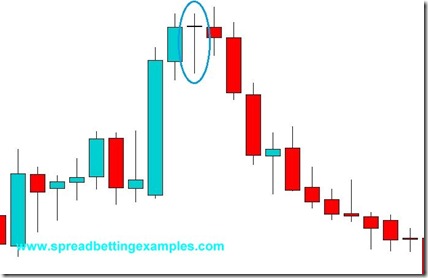

A hanging man is often applied to many price action spread betting strategies. Below is a spread betting example of the hanging man.

How to trade the hanging man?

Below is a Forex Spreadbetting example of the hammer in GBPUSD. As you can see the bulls were in control, pushing prices higher until they met resistance. In the hammer the bears pushed the prices lower but the bulls were able to give a last push higher, forming the hanging man. On the next candle the bears took control and pushed prices lower.